What is eTradePay.com?

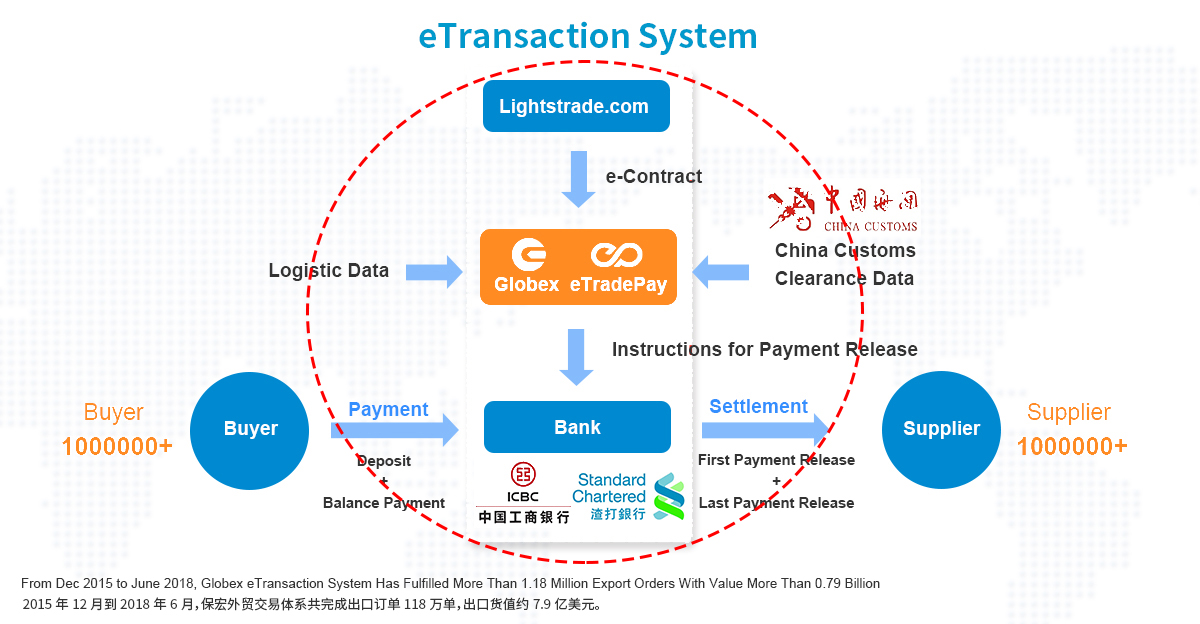

eTradePay.com is the online settlement system for international trade (B2B) that makes transaction more efficient and secure.

Powered by eTradePay.com, Lightstrade.com has been upgraded from a display platform to an online transaction marketplace for lighting industry worldwide. eTradePay.com empowers data by cross-checking digital information from key procedures of the whole trade to intelligently implement the e-Contract signed by the Buyer and Supplier, and protects the interests of both parties.

How is Transaction Secured?

Through digital linking-up with related parties in the trade process by real time including:

●China Customs and Customs Brokers

●Logistic Companies

●Payment Tools

Lightstrade.com enhances the transaction security in the event of:

●E-contract

●Payment

●Shipment

●Customs clearance

●Delivery

Build up the trust between Buyer and Supplier

How Buyer’s payment is released?

Lightstrade. com designates eTradePay. com as payment tool to secure and implement the transaction. Buyer and Supplier can negotiate terms of payment flexibly prior to signing the e-Contract. Once e-Contract signed, eTradePay will implement the terms of payment strictly and automatically.

●First payment release to supplier upon Customs Clearance Proof at loading port

●Last payment release to supplier on the

1)10th Calendar Day after the issuance of Delivery Order by forwarder for sea freight and air freight;

2)5th Calendar Day after the issuance of Cargo Receipt by Courier